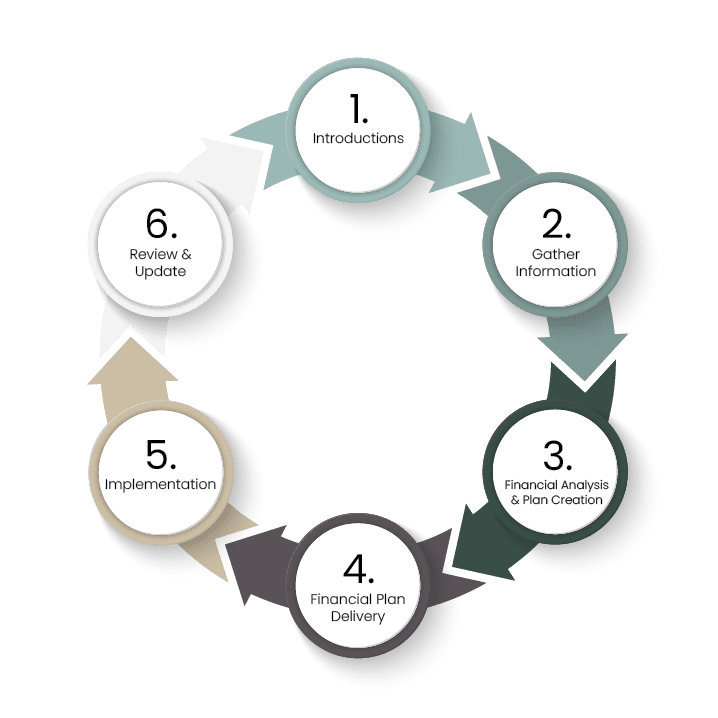

Our Financial Planning Process

1. Introductions

Relationships with our clients come first. This first meeting is when we get to spend some time getting to know each other. We want to know what you value, your financial goals, and what you’re willing to do to reach those goals. We will share who we are, our relationship options and how we work best with our clients. Our goal by the end of this meeting is to decide if working together would be a good fit. We then recommend what next steps need to be taken.

2. Gathering Information

Once we decide working together is a good fit, we will send you a list of financial documents we will need to see in order to complete your financial plan and analysis. We often set up a second meeting to review your financial documents with you and ask any questions that may come up during this discovery process. We will also review goals and present some initial feedback or financial strategies that we feel are important to review with you right away.

3. Financial Analysis & Plan Creation

Now that we have a clear understanding of what’s most important to you, your financial goals, and your financial information we use our knowledge, expertise, and top financial analysis tools to create a financial plan that details exactly what you need to do in order to reach your goals. We provide a written document that details your goals, our observations, and our recommendations to help you efficiently reach your financial goals.

4. Financial Plan Delivery

In this meeting, we present our findings by reviewing the analysis and our written recommendations with you. There may be many recommendations you will need to implement in order for you to reach your goals. Generally, the implementation of a financial plan is on you. We know that a great financial plan is meaningless if you don’t implement it. We will help you prioritize what you should focus on first and help you implement those recommendations in order of importance.

5. Implementation

Our clients typically have many recommendations they need to work on implementing when they first begin working with us such as investment reallocations, risk management strategies, savings and budgeting strategies, tax efficiencies, etc. We can set up follow-up meetings to help you implement those recommendations on a schedule that works for you. We are able to directly help with implementation of some recommendations such as setting up retirement savings, investment reallocations, or risk management strategies. And some of the recommendations you may be responsible for, like setting up a budgeting system. We will be your accountability partner and make sure you are taking action on those recommendations.

6. Review & Update

The world of finances is always changing and so is the world around you and your unique goals and challenges. We meet with you on a previously agreed-upon schedule to review your plan, any changes that have come up, update your financial analysis and the written recommended plan, and help you implement any new strategies that are required.

Address

14670 S Robert Trail, Rosemount, MN 55068

Talk or Text

Office: 651.200.2026

Emily: 651-372-3382

Leah: 651-661-3335

Jackson: 612-400-7674